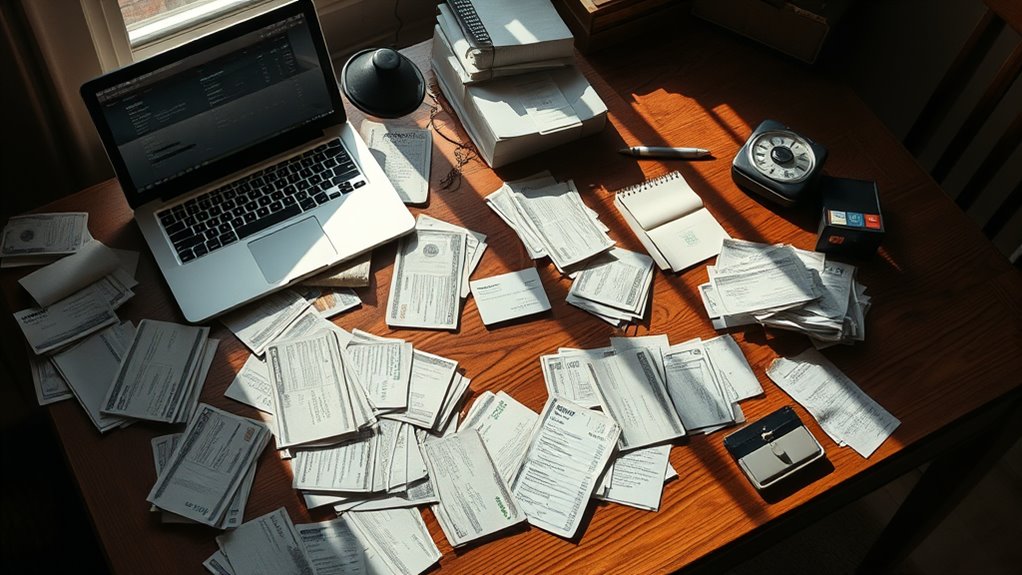

To uncover a narcissist’s hidden debts and secret stashes, look for signs like unexplained asset transfers, offshore accounts, and strict control over financial information. Notice discrepancies between their claimed wealth and actual lifestyle, or sudden changes in behavior around money. Pay attention to secret accounts, shell companies, or risky investments. Using investigative tools, you can identify these deceptions and protect yourself. Keep exploring to learn more about how to spot and address these financial secrets effectively.

Key Takeaways

- Look for inconsistencies between claimed wealth and lifestyle, such as unexplained asset transfers or sudden expenses.

- Use forensic accountants and legal tools to uncover hidden accounts, offshore holdings, or concealed debts.

- Monitor for delayed financial disclosures, secret credit cards, or restricted access to joint accounts.

- Be alert to behaviors like hoarding cash, hiding assets under others’ names, or risky investments.

- Conduct thorough financial audits and seek objective advice to detect deception and protect assets.

Recognizing Signs of Financial Secrecy in Relationships

Financial secrecy in relationships often signals underlying control or manipulation. You might notice hidden bank accounts or secret stashes used for personal luxury purchases, which are common tactics to hide financial activity. Statistics show that 40% of people admit to hiding financial information, with 45% equating such deception to physical infidelity (Experian, 2024). These hidden accounts serve as tools for exerting control and maintaining dominance. Such secrecy can create distrust and undermine transparency, making it difficult to build trust. When financial concealment becomes a pattern, it indicates deeper issues of manipulation and entitlement, where one person feels justified in hiding resources to maintain power or indulge in secret spending. Recognizing these signs is vital to understanding underlying abusive behaviors. Financial deception often involves secret credit cards, undisclosed debts, and lying about income, which further complicates the relationship dynamics. Being aware of financial secrecy can help identify patterns that may signal emotional abuse or manipulation. Additionally, research on emotional abuse shows that financial control is a common form of coercive behavior used to dominate a partner. Moreover, the use of coercive financial tactics can erode a partner’s independence over time, leading to long-term psychological effects. Incorporating general ledger coding practices into financial management can also help in detecting discrepancies and suspicious activity early on, providing an additional layer of oversight.

The Psychology Behind Narcissistic Financial Behavior

Your narcissistic tendencies can lead you to believe you’re always in control, so you hide debts and take risks to reinforce that image. Overconfidence makes you underestimate dangers, pushing you to gamble with your finances without considering the long-term consequences. This behavior fuels your need for validation, even if it means risking everything. Research shows that narcissistic individuals often exhibit a heightened sense of self-assurance, which can distort their perception of financial risks. Additionally, airless paint sprayers are designed to handle thick paints without compromising quality, highlighting the importance of proper equipment to avoid costly mistakes. The tendency to dismiss potential pitfalls is closely linked to contrast ratio awareness, which influences how you perceive and respond to financial threats. Developing a protective mindset can help you better understand the roots of your financial risky behaviors and work toward more balanced decision-making.

Control Through Secrecy

Secrecy serves as a powerful tool for narcissists to maintain control over their victims. By hiding debts and stashing money away, they obscure their true financial situation, making it difficult for others to hold them accountable. They control access to accounts and withhold essential information like passwords and transaction histories, creating dependency and eroding trust. This secrecy shields their vulnerabilities, allowing them to dodge responsibility and manipulate perceptions. They often exploit others’ generosity, creating hidden debts or secret reserves to fund concealed lifestyles or escape obligations. This tactic reinforces power imbalances, keeping victims in the dark and dependent. Creating debt in another person’s name is another common strategy used to further entrench control and complicate financial transparency. Additionally, their tendency to manipulate financial narratives can distort the truth, making it even harder for victims to discern reality. Developing an awareness of financial deception tactics can help victims recognize warning signs early and seek support. Recognizing how secrecy and concealment serve as tools of control allows victims to better understand the underlying motives and protect themselves. For example, some narcissists may have a dog breeds background, which they leverage to mask their true financial behavior by associating themselves with seemingly trustworthy or impressive qualities. Ultimately, their deliberate concealment fosters a climate of confusion and helplessness, ensuring the narcissist retains dominance through a web of financial secrecy.

Overconfidence and Risk

Narcissists often exhibit an overconfidence in their own judgment, which leads them to take bigger risks and make bolder financial moves. This inflated self-belief causes you to dismiss expert advice, relying instead on personal intuition that you trust implicitly. Your stable self-perception pushes you to see yourself as uniquely capable, making you more willing to pursue volatile investments or risky bets, even when evidence suggests caution. This overconfidence results in poorer investment outcomes and higher losses, as you underestimate risks and overestimate your abilities. You tend to ignore external feedback, believing your control over financial results is greater than reality. Research shows that overconfidence is a widespread behavioral bias among financial professionals, including those with narcissistic tendencies. Ultimately, this mindset fuels risky behaviors, often driven by a desire to stand out and maintain your self-image, regardless of the financial consequences. Additionally, the AI security field highlights how overconfidence can lead to underestimating potential vulnerabilities in systems, which parallels overestimating personal judgment in financial decisions. Recognizing the influence of behavioral biases can help you develop healthier financial strategies and avoid unnecessary losses.

How Overconfidence Skews Financial Decisions

When you trust your instincts over expert advice, you risk making decisions that ignore critical data and market realities. Your overconfidence can lead to reckless risk-taking, often fueled by emotional reactions rather than facts. Recognizing these biases helps you make smarter choices and avoid costly financial pitfalls. Being aware of cognitive biases can further support more informed decision-making processes. For example, the tendency to overestimate your own knowledge, known as overconfidence bias, can cause you to dismiss important signals that suggest caution.

Overconfidence and Risk-Taking

Overconfidence can substantially distort your financial judgment, leading you to overestimate your abilities and take unnecessary risks. When you believe you’re invincible, you might pursue high-risk investments or leverage borrowed funds without considering potential losses. Here’s how overconfidence fuels risky behavior:

- Overweight volatile assets like cryptocurrencies and startups, ignoring stability.

- Use excessive leverage to fund lifestyle upgrades or speculative ventures.

- Hide emergency funds or side ventures, avoiding accountability and oversight.

- Reject expert advice, dismissing warnings as laziness or pessimism.

- Misjudge market trends, causing investors to follow fads without proper analysis. Recognizing the importance of risk management strategies can help mitigate these dangers and promote more prudent decision-making. Additionally, overconfidence can lead to overestimating skills, causing investors to ignore warning signs and increase their exposure to potential losses. This mindset can also cause individuals to overlook local laws and legal considerations, which are crucial in safeguarding assets and ensuring compliance during financial disputes. Incorporating self-awareness practices can help investors recognize their biases and make more balanced choices.

Ignoring Expert Advice

Overconfidence leads many individuals to dismiss expert advice, believing they’re more capable of making better decisions on their own. Narcissists often distrust professionals, viewing their insights as inferior or irrelevant. They overestimate their skills, refusing to accept external input that conflicts with their self-image. This mindset causes them to downplay or ignore critical financial analysis, dismissing discrepancies or audit findings as misunderstandings or threats. They might use charm or hostility to undermine experts and justify their choices. By perceiving others as less capable, narcissists justify unilateral decisions and complex asset maneuvers to maintain control. Their exaggerated self-view makes them believe they can navigate financial risks alone, even when evidence suggests otherwise, leading to risky and often hidden financial strategies. Additionally, their tendency to rely on their own perceptions of competence often blinds them to the value of trusted financial advice, further isolating their decision-making processes.

Emotional Biases in Finance

Emotional biases, particularly overconfidence, markedly distort financial decision-making. When you overestimate your knowledge, you’re more likely to take unwarranted risks and trade frequently based on a false sense of expertise. To recognize how this bias influences you, consider these points:

- You might overrate your understanding, leading to high-risk investments. Investors often overestimate their abilities, which can cause them to underestimate potential losses and take on excessive risk.

- You could ignore historical data, trusting your personal analysis instead.

- Overconfidence fuels constant trading, believing you can beat the market.

- Regularly reassessing your risk perception helps counteract this bias. Incorporating content quality and authority principles into your research can also help you develop a more balanced view.

- Recognizing the role of cookie categories and user consent management can aid in making more informed decisions about online information sources.

- Understanding the importance of Kia Tuning options can prevent overestimating your vehicle’s performance capabilities, leading to safer and more effective upgrades. Additionally, awareness of personality traits can help in managing overconfidence by understanding personal strengths and limitations.

The Role of Social Media in Detecting Deception

Social media has become a powerful tool for uncovering deception by analyzing behavior patterns and content shared online. You can spot narcissistic traits through excessive selfie posting, especially on visual platforms like Instagram, which correlates with higher narcissism. Narcissists often use fewer platforms but post highly curated, strategic content, showcasing luxury items or lifestyle upgrades without financial proof. Sudden shifts in tone—like increased self-promotion or hostility—may signal attempts to control narratives during disputes. Look for inconsistencies, such as claims of wealth that don’t match documented income or abrupt content changes highlighting new riches. Engagement patterns, like inflated follower counts or disproportionate likes, can also reveal artificial validation efforts. By analyzing these online behaviors, you gain insight into potential financial deception rooted in narcissistic tendencies.

Common Tactics Narcissists Use to Conceal Debts

Narcissists often go to great lengths to hide their debts, using a variety of manipulative tactics to maintain control and avoid accountability. They exploit credit obligations by placing bills in your name while keeping assets concealed. They also secretly max out credit cards and blame you for overspending. To sabotage your credit, they neglect debt payments in your name, damaging your score. Additionally, they acquire new loans without your knowledge, hiding these obligations to keep their financial secrets. These tactics allow them to maintain a false image of financial stability, while secretly amassing debts. They may also open new accounts or loans in their name without your awareness to further complicate your understanding of their financial situation. By manipulating credit and concealment strategies, they ensure their deception stays intact, making it harder for you to uncover the truth.

The Impact of Financial Deception on Partners’ Well-Being

Financial deception deeply affects your well-being, often leading to profound psychological and emotional distress. You may experience heightened anxiety and depression as unexpected debts or secrets trigger emotional instability. Trust in your partner erodes, making you question their honesty beyond finances, which damages emotional intimacy. Feelings of helplessness can take over, especially when financial control leaves you feeling trapped and powerless. Chronic stress from financial strain fosters resentment, weakening your bond and causing emotional detachment. Guilt and shame often follow, especially if your partner blames you for financial issues, damaging your self-esteem. This deception also strips away your sense of financial security, making future stability uncertain. Financial deception can also lead to legal complications, such as hidden assets or undisclosed debts, further complicating recovery. Overall, your mental health and sense of safety suffer, complicating recovery and rebuilding trust.

Strategies for Uncovering Hidden Wealth and Debts

To uncover hidden wealth and debts, you need a strategic approach that combines careful investigation with legal and financial expertise. Start by:

- Seeking out secret accounts or offshore holdings, like shell companies or cryptocurrency wallets, which narcissists often use to hide assets. Being aware of these tactics can help you identify potential hiding places for assets

- Investigating enabling family members or third parties who might store or transfer hidden funds on their behalf.

- Auditing joint accounts for unusual withdrawals or spending patterns, and monitoring sudden financial changes.

- Leveraging legal tools such as forensic accountants, subpoenas, and full financial disclosures to identify discrepancies and uncover concealed assets.

Building Financial Awareness to Protect Yourself

Building financial awareness is essential for protecting yourself against manipulation and hidden assets. Start by recognizing red flags like unexplained asset transfers, offshore accounts, or delays in sharing financial records. Pay attention to inconsistencies between reported income and lifestyle, and watch for strict control over joint accounts. Understand that narcissists often associate money with power and may hoard cash or hide assets through complex legal structures or assets under others’ names. They might engage in risky investments or ignore market trends, overestimating their abilities. To safeguard yourself, establish strict documentation protocols, conduct regular audits, and seek objective financial advice. Increasing your financial literacy helps you identify red flags early, empowering you to take proactive steps and protect your financial interests effectively.

Frequently Asked Questions

How Can I Differentiate Between Genuine Financial Secrecy and Malicious Deception?

To differentiate genuine financial secrecy from malicious deception, pay attention to how your partner handles transparency. If they respect your questions and gradually share details, it’s likely genuine. But if they deflect, lie, or gaslight, it signals manipulation. Notice if they create power imbalances, restrict access, or hide large sums for reasons beyond personal privacy. Consistent dishonesty or control tactics reveal a pattern of deceit, not just privacy.

Are There Specific Red Flags in Social Media That Indicate Financial Manipulation?

Think of social media as a mirror reflecting hidden shadows. Red flags appear when luxury posts hide financial struggles, or when vague comments mask accountability. Watch for staged images of wealth contrasting with dismissive attitudes toward partners’ concerns. Unexplained transactions or secretive payment methods hint at manipulation. These signals suggest the person’s online persona isn’t just about image, but a carefully crafted facade masking deeper financial control and deception.

What Psychological Traits Most Strongly Predict Financial Deception in Narcissists?

You want to know which psychological traits predict financial deception in narcissists. Their exploitative nature, high entitlement, and overconfidence are the strongest indicators. They often believe they’re superior, justify risky or unethical financial acts, and hide assets to protect their image. Their lack of empathy makes them indifferent to social costs, while their grandiosity fuels flashy spending and secrecy. These traits collectively drive their tendency to manipulate finances for personal gain.

Can Financial Deception Be Linked to Other Forms of Emotional Abuse?

Imagine walking through a fog where truth is hidden behind shadows—that’s what financial deception feels like. You might notice how it’s often intertwined with emotional abuse, like a web that traps your trust. When a narcissist manipulates your finances, they erode your sense of security, fueling mistrust and fear. This silent sabotage destroys your confidence, leaving you doubting your worth and struggling to find clarity amid the chaos.

How Does Financial Secrecy Affect Long-Term Relationship Trust and Stability?

Financial secrecy can seriously damage your long-term trust and stability. When your partner hides money or lies about finances, you start doubting their honesty and intentions. This erodes emotional safety, making it hard to build a solid foundation. Over time, the constant suspicion and betrayal can lead to misunderstandings, emotional withdrawal, and even breakup. To maintain trust, open communication and transparency about finances are essential.

Conclusion

Remember, honesty is the best policy—especially in finances. By staying alert to signs of secrecy and trusting your instincts, you protect yourself from falling into a narcissist’s financial trap. Keep your eyes open, ask questions, and don’t ignore red flags. As the saying goes, “A stitch in time saves nine.” Being proactive now can save you from bigger heartbreak and financial chaos down the road. Stay vigilant and prioritize your well-being.